The timing of when you will receive a 90-Day Pre-Foreclosure Notice varies from case to case, but typically if you fall 30 or more days behind you will likely receive this letter. Under New York State law, this letter is required to be sent to you. The Bank must wait at least 90 days from sending this letter before they begin a foreclosure action against you. This 90-day window gives you the opportunity to try to work with the Bank to find an alternative to foreclosure. This notice must tell you how much you must pay to bring your loan current. It must also provide the names and telephone numbers of at least 5 not-for-profit housing counseling agencies serving your county.

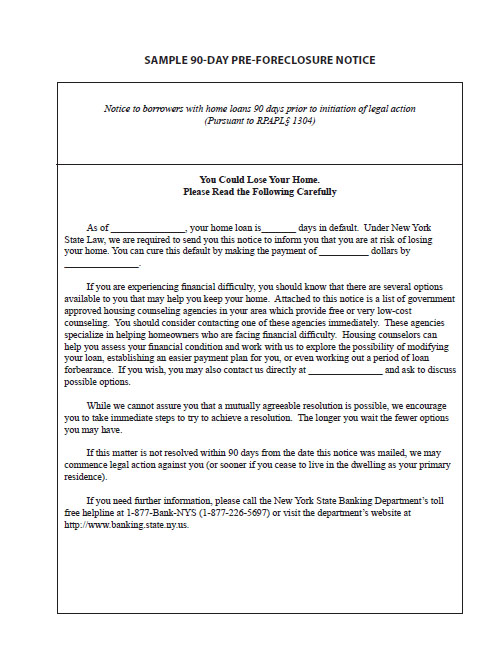

- This is an example of what a 90-Day Pre-Foreclosure Notice looks like. 90-DAY PRE-FORECLOSURE NOTICE