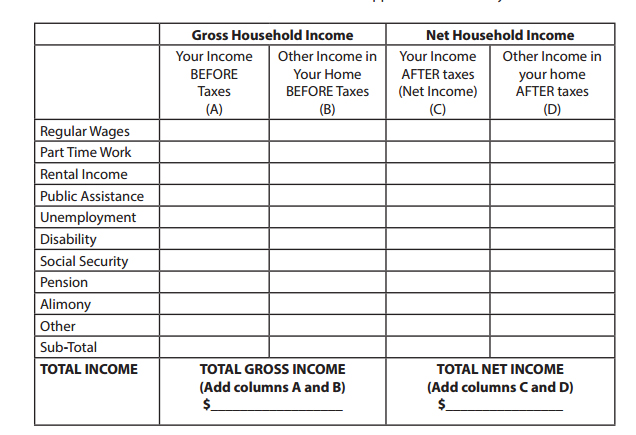

First, you need to compute your total monthly income. Listed below are the most common sources of income. You want to list all of your personal sources of income (Column A), as well as any other income from anyone else in your house if they are helping contribute to the mortgage (Column B) Household income

- Please remember that you MUST be able to verify all the sources of income you use in the budget.

- Your Bank will not consider sources of income without accompanying verification.

- If you are using another household member’s income in your budget, count that person’s expenses as well and make sure you have verification of their income.

-

Monthly Income

-

Gross Household Income

Adding columns A and B gives you your “Total Gross Household Income.” This amount is $_______. Multiply this number by .31. This equals $_________, and we will refer to this as your “31% Payment”. Most of the large banks in the country have recently settled on 31% as being one of the main standards they use in determining if a payment is affordable – anything above 31% is often looked at as being too high. Therefore, your 31% Payment is an approximate amount you should expect to pay in total for your first mortgage, homeowners insurance, property taxes and condo fees/homeowners association fees. Remember, there is no law that says you cannot pay more than 31% -- this is merely meant as a guide to give you a better idea of what many of the national banks have recently done. In addition, if you were paying less than this before you defaulted, be prepared for your mortgage payment to increase to this amount each month.

-

Net Household Income

- Adding columns C and D gives you your “Total Household Net Income.” This amount is $_______. This is how much you actually receive each month, and the amount available to pay your bills.

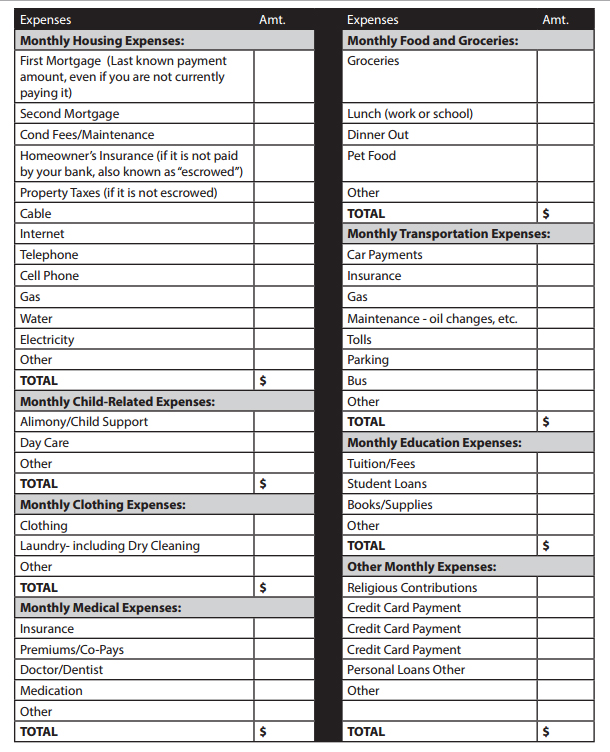

MONTHLY EXPENSES

Now that we have looked at your income, we need to compute your total monthly expenses. Included on the next page (page 20) is a list of typical household expenses you may have each month. Fill in each category as best you can. We realize that it often can be diffi cult to estimate certain categories, such as how much you spend on food each month. However, it is vital for you to fill this out as accurately as possible. The only way to make an accurate determination if you can aff ord your home is to look at what else you are spending your money on. You will likely have to fi ll out a very similar form for your Bank, so working on your budget now will help you.

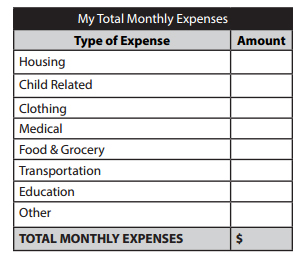

- Now take each of the subtotals from your

expense list and copy them in below.

Next you need to calculate how much money you have after you pay all your bills, or how much more you are spending each month than you are earning. Take your Total Net Income, which you calculated earlier, and subtract your Total Monthly Expenses, which you just calculated.

- Total Net Income $____________

- Total Monthly Expenses $____________

- MONTHLY SURPLUS/DEFICIT $____________

- If this amount is negative, it is referred to as your “monthly deficit”. If this amount is positive, it is referred to as your “monthly surplus”. If you have a monthly deficit, do you see any sources of income that you can increase, or any expenses you may be able to cut back on? In addition, look at the 31% Payment we calculated earlier. If we plugged the 31% Payment amount into your budget in place of the current Monthly Mortgage Payment, would that be enough to turn your monthly deficit into a monthly surplus? If not, you may not be able to afford your home and you should seriously consider other options (such as a “short sale” or a “deed-in-lieu of foreclosure”).

-

Additional Resources